Purpose

The purpose of Claremont Graduate University (CGU) Tuition Benefit policy is to encourage eligible employees of CGU to take advantage of the educational opportunities offered by the Claremont Colleges.

Who is eligible?

- Full-time professors, associate professors, assistant professors, administrative staff, and other staff will become eligible under this Tuition Benefit policy after one year of continuous employment. Transfers from another Claremont College with one year of continuous full-time service become eligible at the beginning of the next semester after transfer.

- When eligibility is established within a semester or summer session, the employee is eligible for the benefit the beginning of the next full semester or summer session.

- Employees who have worked in regular positions at least 20 hours per week but less than 32 hours per week, and whose hours per week worked are increased to 32 or more on a regular basis, become eligible under this Tuition Benefit policy at such time as their total hours worked as a regular employee reach 1,664 or 32 hours per week for 52 weeks.

- Eligible employees must be actively employed through the entire semester to remain eligible for tuition payments.

Amount of Tuition Benefit

- Full tuition payment is made for one course or four (4) units per semester (including summer session) taken for credit in a degree program at any of the Claremont Colleges, including the Certificate Programs at CGU.

- The program does not cover the cost of student fees, lab fees, library fines, books or any other non-tuition related expenses.

- The maximum entitlement is eight full-time equivalent (FTE) semesters of undergraduate course work, six FTE semesters in graduate course work and six semesters of Continuing Registration or Doctoral Study.

- In any event, no more than six FTE semesters of graduate course work will be supported. Tuition Remission benefit eligible employees are not eligible to receive any additional institutional funding. Staff members can only take one course or four (4) units per semester whether through the tuition remission program or paid for personally.

- Employees who have already earned a baccalaureate degree from an accredited undergraduate college are not eligible for undergraduate course work under this policy.

- Payment will be made to the appropriate undergraduate institution or CGU only after evidence is received of successful completion of courses taken. A new application for tuition benefit must be submitted for each semester or module.

Taxability of Benefits

The Internal Revenue Service (IRS) and the State of California Franchise Tax Board determine the taxability of certain tuition benefits received by an employee and their dependent(s). As the following table illustrates, taxation is based upon the student-to-employee relationship and the course level of the classes taken. Under certain conditions, the IRS does allow an exemption of $5,250 per year per employee (Section 127 of Internal Revenue Code. Note: IRC Sec. 127 only applies to employees; it does not apply to spouses, dependents.

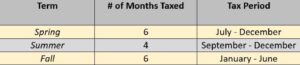

Taxation Schedule

In accordance with applicable federal and state tax laws, CGU will withhold taxes from the employee’s gross wages according to the following schedule. The total taxable tuition remission benefit amount will be divided by the number of months listed below. The IRC Sec. 127 $5,250 qualified exemption (if applicable) will be applied during the first tuition application terms in the year until the entire $5,250 exemption is exhausted. All adjustments will be made in a payroll period dedicated to adjustments (general timeline is below). If you are a biweekly employee please refer to the payroll schedule.

*Please note that payment will be issued once HR receives confirmation of passing grades for the semester.

After the census date each term, and based upon the enrollment on that date, Human Resources will send an email to the employee outlining the tax impact for the pertinent payroll integration period. Employees who do not receive this email are responsible for notifying Human Resources that they should be taxed. Tax periods cannot be extended past the term noted on the above table for any reason.

If an employee’s gross pay is not sufficient to cover the tax liability, the employee will be required to pay the taxes owed prior to the first day of classes; otherwise, the student receiving these tuition remission benefits will be administratively withdrawn.

If an employee terminates employment within a taxing period, the employee will be required to pay the taxes owed or unenroll from classes prior to the termination date.

Questions related to the taxable remission amounts should be directed to Human Resources at human.resources@cgu.edu